Learn How to Recognize & Prevent Double Billing

Picture this: An attorney spends five hours on a flight to take an out-of-town deposition for Client A. During that time, the attorney works on IP management research to use for projects for both Client B and Client C. How many billable hours can the attorney invoice for, and which client(s) should receive the bill?

This may sound like one of those word problems from your high school math class, but it’s actually a great example of how double billing happens all the time. But just because it happens often doesn’t mean you can’t prevent it.

The best way to get ahead of double-billing issues is to learn the most common ways law firms overcharge for their services.

What is Double Billing?

Double billing occurs when a lawyer bills two or more clients for the same period of work or charges for exaggerated time entries due to oversight or error. This practice, often viewed as a breach of ethical billing standards, can be difficult to detect and lead to clients being overcharged. By identifying and addressing double billing, clients can better manage legal costs and ensure transparent, accurate billing practices.

Improper Billing Practices

Although they’re not always malicious, improper billing practices often lead to double billing or overbilling for work.

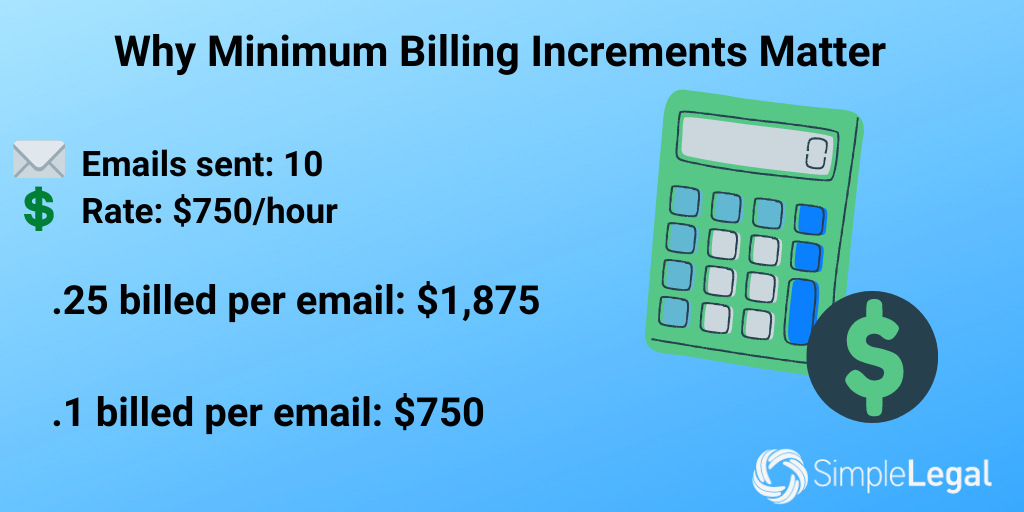

If an attorney sends an email related to your matter, you can count on them billing for their time. But how long did they really spend on that message? Many hourly timekeepers default to increments of 0.25 (15 minutes) instead of 0.1 (6 minutes). It may not seem like a big difference, but those nine-minute increments can add up pretty quickly.

Other improper billing practices include “padding” time or billing under the wrong timekeeper rate. Because not all work is billable, some firms will attempt to “pad” their invoices to make up for nonbillable time spent researching, doing administrative work, and other similar tasks. Firms may also submit invoices with work attributed to the wrong timekeeper, such as an associate billing at a partner rate.

You can prevent these costly oversights by clearly defining your expectations in your legal billing guidelines. Establishing firm rules around minimum billing increments, billable versus nonbillable work, and approved timekeepers can stop double billing and overbilling before they start.

Lawyer Billing Ethics

Because there aren’t always clear rules when it comes to double billing, it often boils down to what is and isn’t ethical. Make sure you don’t end up paying for work that falls under one of these common ethical dilemmas.

Double Billing Two Clients for the Same Work

Lawyer billing ethics state that you can bill only for time worked — but what if the work applies to multiple clients? This question comes up when attorneys attend a meeting on behalf of multiple clients or perform research that applies to more than one case.

Regardless of how many clients benefit from the work performed, it’s unethical for lawyers to bill each client individually for the full time spent. To avoid double billing, attorneys should split the bill among the clients. So if a one-hour meeting applies to four clients, each client should be billed for only .25 (15 minutes).

Double Billing to Invoices to Hit Hourly Quotas

Law firms often have billable-hour quotas that require each attorney to bill at least 1,800- 2,000 hours per year. At first glance, that seems reasonable, considering 2,000 breaks down to about eight hours a day over the course of 261 working days per year. But not every hour of the workday is billable.

Attorneys end up feeling pressured to bill more hours to prove their value to their employer while also desperately trying to maintain some semblance of a personal life. This can lead to overbilling or double billing for time. For example, a timekeeper might bill for a full hour when a 15-minute increment would be more appropriate. Theoretically, an attorney could take four 15-minute calls in one hour and bill for a total of four hours.

Double Billing During Travel Time

Most attorneys bill for time spent traveling to depositions, meetings, or anything pertaining to their work. However, when they use that travel time to work on other cases, double billing becomes an issue.

While there’s nothing wrong with catching up on Client B’s work while traveling for Client A — the question is, who foots the bill? Lawyers may try to justify billing both clients for the same time, but the ABA declared this practice unethical. You can bill for only the actual hours worked, so charging both clients would be double billing.

In this case, the attorney would be better off spending the flight time catching up on a Netflix series while snacking on honey-roasted peanuts and just billing Client A for the travel time.

Administrative Errors Leading to Improper Billing

Not all invoice workflows function like a well-oiled machine. When a large part of the invoice submission and review process is manual, administrative errors are inevitable.

Manual invoice submission and review could lead to the same bill being submitted and/or paid more than once. Invoices pass through multiple hands, both on the law firm and on the legal department side, which leaves a lot of room for human error.

Time blocking — lumping work into a time block instead of breaking it down by UTBMS task code — also can lead to double billing or overbilling. Detailed invoices are crucial for proper spend management. Without a breakdown of the work performed, invoices could be loaded with issues ranging from time padding to billing all timekeepers (regardless of experience level) under the same rate.

SimpleLegal’s e-Billing system can automatically review invoices to check for potential double billing and billing-guideline violations. You can even use SimpleLegal to automatically reduce or reject invoices according to the rules your team establishes.

Prevent Double Billing with SimpleLegal

Now that you know how to identify the common causes of double billing, can you solve the word problem from the beginning of this article?

The answer is five total hours.

Even though the attorney is traveling for Client A while doing work for Clients B and C, it would be unethical to charge for 15 hours of work for only a five-hour period. As for who receives the bill, it would make the most sense to charge Client A for travel time. Every minute of travel is necessary and billable while the attorney couldn’t possibly spend the full five hours of travel time researching for Clients B and C.

Manually checking for double billing or overbilling is arduous, and manual processes force you to waste time disputing invoices. See how SimpleLegal can help you can gain control over the invoicing process and easily monitor your legal spend.