Alternative fee arrangements allow for more control over legal spend

With hourly billing rates on the rise, alternative fee arrangements — legal agreements that do not use the traditional hourly fee structure — are becoming more common. In fact, an Altman Weil survey of both large and midsize law firms showed 95% of firms use these arrangements.

This is great news for legal ops teams who are looking to gain better control over their legal spend. However, moving to alternative fee arrangements isn’t as simple as flipping a switch. Here’s how to implement and manage alternative fee arrangements in your legal department.

Start with Negotiation

Your outside firms may be more open to alternative fee arrangements than you’d think. Two-thirds of firms that use alternative fee arrangements say the primary reason is that clients requested them.

During negotiations, focus on value delivered instead of time spent. The Association of Corporate Counsel (ACC) lays out six steps for executing alternative fee arrangements, the first of which is defining value. Think of it this way: Manual data entry may take several hours, but does it offer a lot of value? Conversely, renewing a patent could be quick, but it’s a big deal for companies that need to protect their patents.

Remember that legal-ops teams and outside firms should work as partners, so it’s important to explain the benefits for both sides. Firms may balk at the idea of giving up hourly billing. It’s up to you to show them how an alternative fee arrangement can make their professional lives easier as well.

Know How to Sell the Benefits

Whether you’re pitching a shift to alternative fee arrangements to the director of legal ops or to an outside law firm, knowing how to present the benefits is key.

Alternative fee arrangements bring more predictability to your legal spend, but how does that benefit everyone involved? For your legal-ops team, it means being able to more accurately forecast future budget needs. This a major selling point for stakeholders who want to make data-driven budget decisions. Deciding on which outside firms to use for different types of work is more intuitive as well. If two firms both specialize in tax law, but one has an alternative fee arrangement, and the other uses hourly billing, that could be the deciding factor.

Alternative fee arrangements allow outside law firms to predict how much work (and income) to expect on a rolling basis, which is much more reliable than trying to estimate how many billable hours they can fit into a month. Be sure to remind outside counsel that predictability also helps them plan their ongoing staffing needs.

Another major benefit of alternative arrangements is a more efficient invoice workflow. On the legal-ops side, that means less friction with finance and accounts payable. With fixed-fee agreements, there’s no need to review invoices line by line to verify UTBMS task codes, timekeeper rates, etc., which means there are fewer billing disputes between legal ops and outside firms.

Fewer disputes is a significant benefit for law firms as well. No one wants to waste time and resources battling through line items on an invoice. Convince outside counsel to make the switch by highlighting how many billing-dispute headaches they can avoid by working on a fixed-fee basis.

Create a Process to Manage Alternative Fee Arrangements

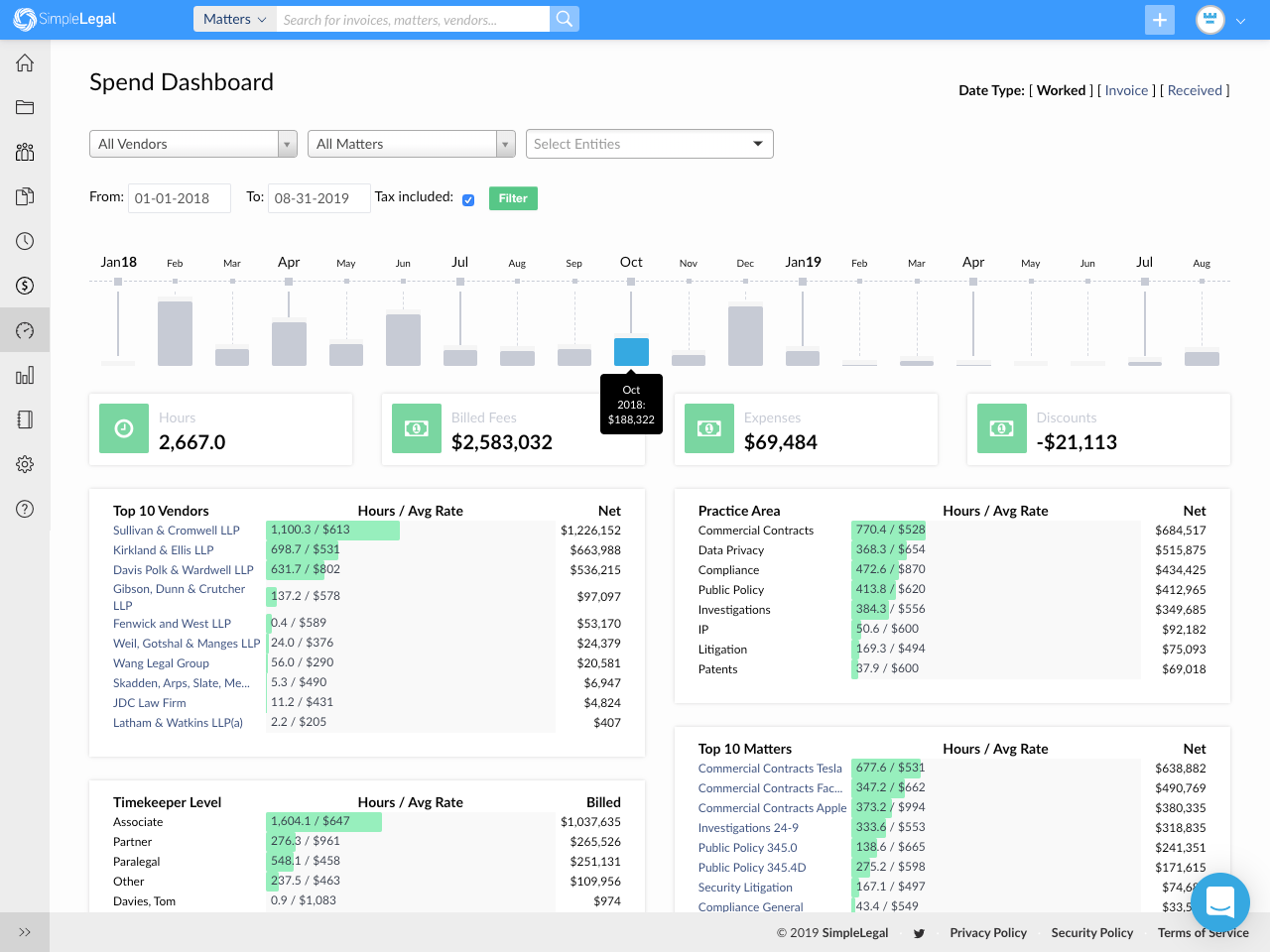

To get the full benefit of alternative fee arrangements, you need a system in place to track and enforce them. Unfortunately, many legacy e-Billing and spend management platforms have been reactive in their support of alternative fee arrangements. They are unable to delineate between flat fees and hourly fees. This makes it impossible for legal to get an accurate depiction of their hourly timekeeper rates because there are flat fees mixed in.

Use a comprehensive spend management platform like SimpleLegal. Our system understands the difference between a fixed fee and an hourly rate, making it possible to separate each into their appropriate bucket. This is important if your team is interested in more granular reporting and a clearer understanding of overall legal spend with outside counsel. Using a spend management platform also allows you to automatically reject or adjust invoices if they bill hourly for work that should be a fixed fee.

Once you have your process in place, you can track spend associated with alternative fee arrangements and hourly rates, which can help you set up budgets for specific practice areas and tasks, such as IP management. Additionally, these budgets can be limited with fee caps. When the budget exceeds a certain amount, the legal team is notified so they can intervene as soon as possible.

Alternative Fee Arrangements Are Here to Stay

According to the aforementioned Altman Weil study, one-third of law firms that use alternative fee arrangements say the main reason they use them is to gain a competitive advantage. Law firms want to make their clients happy. Bringing more transparency to billing plays a large part in achieving this goal and is something more law firms will be adopting as alternative fee arrangements continue to be a key request from legal teams.

If you’re a modern legal department looking for more transparency and want to gain control over your legal spend, schedule time to see a demo of SimpleLegal. A better way to manage your invoices, matters, budgets, and accruals is just around the corner.