Accruals management part II: best practices for improving your accruals process

In part I of our accruals management series, we summarized why accruals are important, and how legal operations departments tend to be more equipped to own the accruals process than finance departments because they’re closer to the work that’s being done – advice taken from the 2017 CLOC Institute session on accrual management, presented by SimpleLegal CEO, Nathan Wenzel, and Head of Legal Operations at Waymo, Nigel Hsu.

Part II of this series will focus on how legal operations teams can train and inform internal teams as well as outside law firms in how the accruals management process should operate within any given organization.

Working with Internal Teams to Improve Accruals Management

From your in-house attorneys and general counsel to accounting and finance, there are multiple internal teams that need to be involved in the accruals process; getting them all to work together can be an uphill battle, especially in larger organizations.

Process Implementation

To help legal operations own accruals and manage internal teams, Nathan stressed the importance of implementing a process where accruals are sent back to those involved with the actual legal matters to ensure accuracy.

For instance, by routing invoices back to the attorney, he or she can identify any outliers with an initial “gut check”. As mentioned earlier, legal operations and attorneys are close to the work. If charges for this month doubled what they were last month for a particular law firm, the legal operations department is more equipped than any to ask and answer, “Did I ask the law firm to do double work?”

The second step in ensuring the right numbers are reported is to create a period of time between the accruals booking deadline and the submission of the accrual. This provides a few days of buffer to review invoices, and push them to outside counsel or to another internal team, ensuring that the right numbers are logged at the end of the month.

Consistent Monthly Internal Meetings

At month close, there should always be a meeting between legal operations, finance, and accounting to go through numbers. Finance and accounting are usually asking, “What happened here? Why did this number jump?” It’s the job of legal operations to make them feel comfortable and show they understand what’s going on with the budget and accruals.

Working with Outside Law Firms to Improve Accruals Management

A company’s CEO, CFO, and accounting departments rely on their general counsel and legal operations teams to make sure there are no surprises, just as legal departments rely on their firms to provide timely invoices and to provide estimates of what those invoices will be at the end of each month.

Getting to this place requires two main things.

- Getting legal teams to work closely with law firms, making sure each firm or vendor understands the importance of accurate and timely accruals.

- Arming law firms and vendors with all the information and tools they need for success.

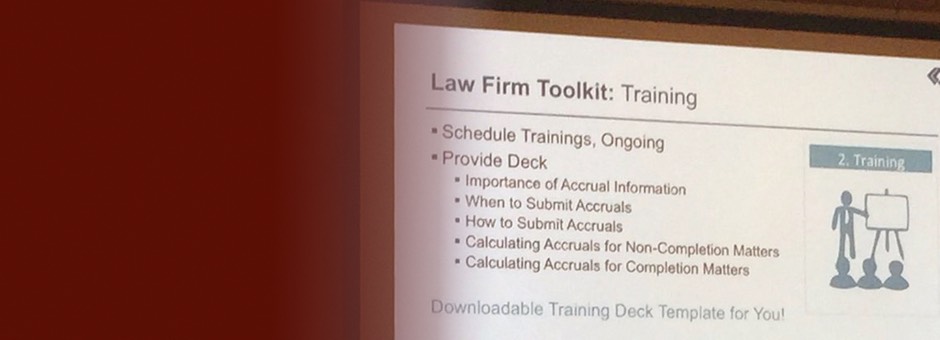

To increase confidence in your accruals numbers and to help your law firms be as accurate as possible, communicate expectations and process in a clear way that can be referenced when a particular problem arises. SimpleLegal gave session attendees a customizable Law Firm Training Deck that provides the framework for training your law firms on the importance of accruals, how to accurately and effectively calculate them, and how and when to submit them. Click here to download the training deck template.

Turn Accruals into a Math Problem, Not a Guessing Game

By aligning the right processes with accruals management, legal operations teams are better able to understand spend with law firms, can bring more predictability and reliability to the accruals process, and can act a reliable resource for accruals within their own organization.

Align Accruals Management with Software for More Streamlined Reporting

The session closed out by highlighting legal technology software, which can act as the system of record for accruals management. This way, the attorneys working on the matters can easily access data and information related to accruals in one consolidated place, while finance, accounting, and management teams can access the information most important to their roles and responsibilities. Everyone has a way to check the status of accruals, allowing them to find and prevent issues as early in the process as possible.

Attendees walked away from the session with new processes for automating and streamlining accruals management, as well as a framework for how to approach law firm training. If you have lingering questions about accruals or are interested in seeing how a legal technology platform like SimpleLegal can help to create a more efficient accruals process for your organization, don’t hesitate to reach out!